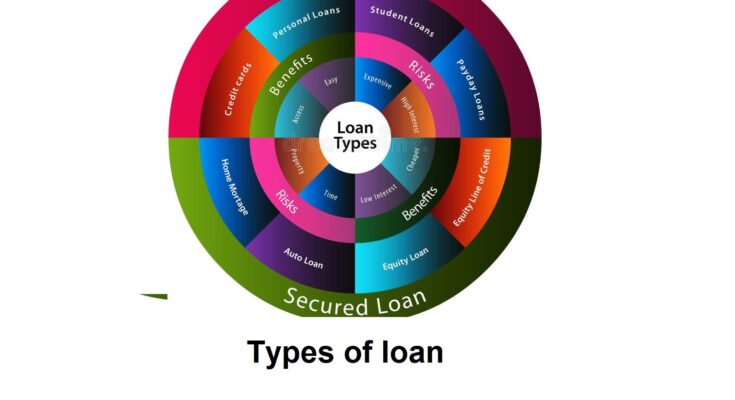

There are various types of loans, each designed for specific purposes and with different terms, interest rates, and eligibility requirements. Below is an explanation of the most common types of loans:

1. Personal Loans

- Purpose: Personal loans are versatile and can be used for a lot of functions, along with debt consolidation, scientific expenses, domestic renovations, or even holidays.

- Secured vs. Unsecured: Personal loans can be either secured (backed through collateral) or unsecured (no collateral required). Unsecured loans commonly have better hobby costs.

- Interest Rates: Interest costs range depending at the borrower’s credit score and may be constant or variable.

- Terms: Repayment periods typically range from 1 to 7 years.

2. Mortgage Loans

Purpose: Used to buy real property, like a home or assets.

Types:

- Fixed-Rate Mortgage: The hobby price stays steady during the mortgage time period, normally 15 to 30 years.

- Adjustable-Rate Mortgage (ARM): The interest fee is constant for an preliminary length after which adjusts periodically based on market conditions.

- FHA Loans: Backed by way of the Federal Housing Administration, those are designed for low-to-mild-income borrowers and require decrease down bills.

- VA Loans: Available to veterans and provider individuals, sponsored via the Department of Veterans Affairs, often requiring no down charge.

- Terms: Typically 15 to 30 years, however can range.

- Interest Rates: Varies based at the kind of loan and marketplace situations.

3. Auto Loans

- Purpose: Specifically for purchasing a car, along with automobiles, vehicles, or motorcycles.

- Secured Loan: The automobile itself serves as collateral for the loan.

- Terms: Usually three to 7 years.

- Interest Rates: Rates depend upon the borrower’s credit score score, the term of the loan, and the vehicle’s age.

4. Student Loans

- Purpose: To cover the costs of higher education, which includes training, costs, room, board, and different education-related prices.

Types

- Federal Student Loans: Offered by means of the government with fixed hobby charges and numerous reimbursement options.

- Private Student Loans: Issued by way of private lenders with variable or fixed interest rates, regularly requiring a credit check.

- Terms: Repayment commonly starts after graduation, with phrases ranging from 10 to 30 years.

- Interest Rates: Federal loans have decrease, fixed prices, even as personal loans range based at the lender.

5. Business Loans

- Purpose: To start, operate, or expand a business.

Types:

- Term Loans: Lump sum paid lower back over a fixed length with hobby.

- SBA Loans: Backed by using the Small Business Administration, supplying lower interest quotes and longer terms.

- Lines of Credit: A revolving credit line that organizations can draw from as wished.

- Terms: Varies appreciably relying on the type of mortgage.

- Interest Rates: Can be fixed or variable, prompted by means of the business’s creditworthiness.

6. Home Equity Loans

Purpose: To borrow against the equity in your home, typically for large expenses like home improvements or debt consolidation.

- Home Equity Loan: Lump sum with a hard and fast hobby fee.

- Home Equity Line of Credit (HELOC): A revolving credit score line with variable interest costs.

- Terms: Typically 5 to 15 years.

- Interest Rates: Lower than other non-public loans due to the fact they are secured by means of your own home.

7. Payday Loans

Purpose: Short-term, high-interest loans designed to cover immediate cash needs until the borrower’s next paycheck.

- Unsecured Loan: No collateral required, but normally small amounts.

- Terms: Usually due on the borrower’s next payday, normally 2 to four weeks.

- Interest Rates: Extremely high, frequently ensuing in an APR of four hundred% or greater.

8. Debt Consolidation Loans

Purpose: To combine multiple debts into a single loan with a potentially lower interest rate.

- Secured vs. Unsecured: Can be either, relying at the lender and the borrower’s credit.

- Terms: Varies depending on the amount consolidated and the lender’s phrases.

- Interest Rates: Generally decrease than credit score card rates however range based on creditworthiness.

9. Credit Builder Loans

Purpose: Designed to help borrowers build or improve their credit score.

- Secured Loan: The mortgage quantity is held in a savings account or certificate of deposit until the mortgage is paid off.

- Terms: Typically 6 to 24 months.

- Interest Rates: Lower than traditional personal loans, however the borrower earns little to no interest at the financial savings.

10. Bridge Loans

Purpose: Short-term financing to bridge the gap between buying a new home and selling the old one.

- Secured Loan: Typically secured via the borrower’s current domestic.

- Terms: Short term, typically as much as 365 days.

- Interest Rates: Higher than conventional mortgages because of the fast-time period nature and better hazard.

Each kind of loan has its unique features, blessings, and dangers, making it vital to select the right one based totally on your financial needs and situation.