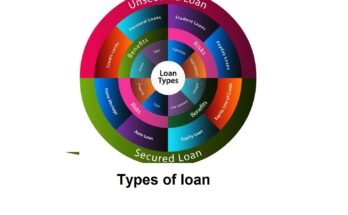

Personal loan

A Personal loan is a type of unsecured loan that you can borrow from a bank or financial institution if you require funds to pay for your financial needs.

Mortgage

A mortgage is a type of loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay the lender over time

Student loan

Student Loans are loans made to eligible undergraduate students who demonstrate financial need to help cover the costs of higher education

Auto loan

An auto loan is a type of loan that allows you to borrow money from a lender and use that money to purchase a car.

Payday loan

A payday loan is a short-term unsecured loan, often characterized by high interest rates.

Pawn shop loan

A pawnbroker is an individual or business that offers secured loans to people, with items of personal property used as collateral.

Small business loan

Small business financing refers to the means by which an aspiring or current business owner obtains money to start a new small business.

Credit builder loan

A credit builder loan is an installment loan with fixed monthly payments, similar to a personal loan, auto loan and mortgage. Payments you make toward your credit builder loan are reported to the credit bureaus and can help you establish a credit score.

Holiday loan

In finance, a loan is the transfer of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money.

Debt consolidation loan

These loans convert many of your debts into one loan payment, simplifying how many payments you have to make.